The first Earth Day may have been in 1970 – 51 years ago – but it seems like the financial markets are just now taking notice.

The financial markets took several key steps over the past few months to address climate change risks and help investors, regulators and business leaders report on them:

1. The Federal Reserve recently declared climate risk and systemic financial risk, on March 19, 2021, stating, “Climate change-related financial risks pose both micro- and macroprudential concerns…[and that] We believe that climate change increases financial stability risks.”

Federal Reserve graphic on climate risk, federalreserve.gov

Federal Reserve, federalreserve.gov

2. The Federal Reserve established a Climate Committee to provide guidance to the Fed on managing this systemic climate risk. In her speech announcing it, Federal Reserve Governor Brainerd stated, “the Federal Reserve Board is establishing a Financial Stability Climate Committee (FSCC) to identify, assess, and address climate-related risks to financial stability. The FSCC will approach this work from a macroprudential perspective—that is, one that considers the potential for complex interactions across the financial system.” The Commodities Future Trading Commission (CFTC) formed a climate committee as well.

3. The Securities and Exchange Commission (SEC) named its first ever Senior Policy Advisor for Climate and ESG, Mr. Satyam Khanna. The SEC press release described his portfolio as to, “advise the agency on environmental, social, and governance matters and advance related new initiatives across its offices and divisions.” Khanna previously spent several years at the SEC, including as a member of the SEC’s Investor Advisory Committee, as a Senior Advisor to the Principles for Responsible Investment and as Counsel to SEC Commissioner Robert J. Jackson Jr. Khanna was on the SEC-related Biden Transition Team.

SEC seeks public comments on climate disclosure, sec.gov

sec.gov

4. SEC asked for public comments on what kinds of information it should mandate be disclosed about climate risk, as they begin to write a new draft rule about it. In her announcement inviting public comments for a 90-day period, Acting SEC Chair Allison Herren Lee stated, “In light of demand for climate change information and questions about whether current disclosures adequately inform investors, public input is requested from investors, registrants, and other market participants on climate change disclosure.”

Herren Lee mentioned that the SEC “has periodically evaluated its regulation of climate change disclosures,” including in 2010, but that “Since 2010, investor demand for, and company disclosure of information about, climate change risks, impacts, and opportunities has grown dramatically. Consequently, questions arise about whether climate change disclosures adequately inform investors about known material risks, uncertainties, impacts, and opportunities, and whether greater consistency could be achieved.” Their goal, they said, is, “facilitating the disclosure of consistent, comparable, and reliable information on climate change.”

5. The World Economic Forum’s (WEF) gathering this year – of top government and business leaders across the globe – had a distinct ESG theme, either stated or implied. In a WEF 2021 video, New Zealand Prime Minister Jacinda Ardern summed it up by saying, “It’s not just growth for growth’s sake, but how we share that prosperity.” The president of the European Central Bank (and former head of the IMF), Christine Lagarde added that, “We have to make sure the economy actually works for the people.”

Joan Michelson article in Forbes on WEF 2021 priorities

Screen shot, Joan Michelson Forbes article

6. The Sustainable Accounting Standards Board, GRI, and the World Economic Forum announced a partnership with other organizations to develop consistent ESG reporting standards, since there are so many versions, making comparison and accountability more difficult for investors and regulators.

The Federal Reserve’s actions are especially notable, stating that the climate risks may be both difficult to predict and have materially negative affects on the economic and financial systems in the U.S. The Fed pointed out that climate disasters result in “deteriorating public health, labor productivity, and agricultural yields, failing public infrastructure, rising mortality rates, and weather-related property destruction among other impacts. Such adverse effects can result in direct financial risks (sic)…[as well as] create risks to economic activity, which can themselves create or amply financial risks,” such as bank losses.

Governor Brainerd added that, “robust risk management; scenario analysis; consistent, comparable disclosures; and forward plans can help ensure the financial system is resilient to climate-related risks and well positioned to support the transition to a sustainable economy.”

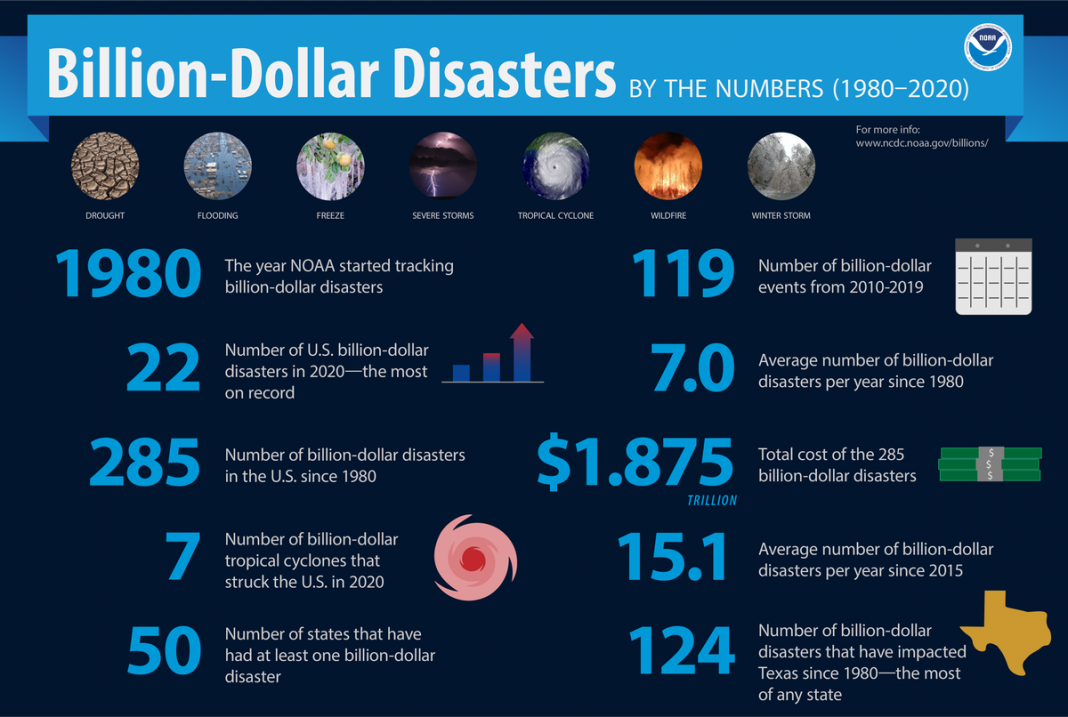

Billion-Dollar Climate Disasters in the US 1980-2020, noaa.gov

NOAA.gov

What triggered this flurry of climate actions by financial agencies and organizations?

Maybe it was that – on top of the pandemic – in 2020 the U.S. had the highest number of severe weather events that cost over $1 billion each in history, 22, according to the National Oceanic and Atmospheric Administration, or NOAA. And, those are only the ones that cost over $1 billion; it does not count those that cost less.

Since 1980, there have been 285 severe weather events costing over $1 billion, costing a total of $1.905.3 billion – or nearly $2 trillion – and 14,492 deaths. President Biden’s infrastructure plan costs almost the same amount, $2.2 trillion, and he says it will do much more than just mitigate climate disasters. He says it will rebuild the country’s dangerously broken roads, bridges and mass transit systems, build a clean energy economy and, jobs. According to the Congressional Budget Office, it will create about 3 million more jobs than the economy would generate without this plan. (It will likely create taxable income as well, from those new jobs, as well as from company growth and the formation of new companies, but figures on that were not available as this article went to press.)

Maybe these financial agencies and organizations stepped up because every U.S. state has had extreme weather events, according to NOAA.

Maybe they felt pressured by the investment and business communities for consistency and guidance.

Whatever the impetus, creating solid, consistent climate risk measures and disclosure requirements is a fitting way to commemorate Earth Day 2021.