Activists representing more than 350 environmental, civic, and college student organizations held a … [+]

LightRocket via Getty Images

Environment, social and governance (ESG) investing is rapidly evolving and soaring – in popularity, performance and tools. But will it make a difference in corporate behavior?

Investing is no longer just about financial returns. It’s about the link between those returns and the impact of that business on society in both the short and long term. It’s about reducing the carbon footprint to “net zero.” It’s about how corporates treat all their stakeholders, from employees to customers, suppliers, investors, and their wider community. It’s about diversity and equity across all levels of their organizations.

The exponential growth of ESG investing could have a long-term and far-reaching impact on our economy and society, if it improves accountability and drives action.

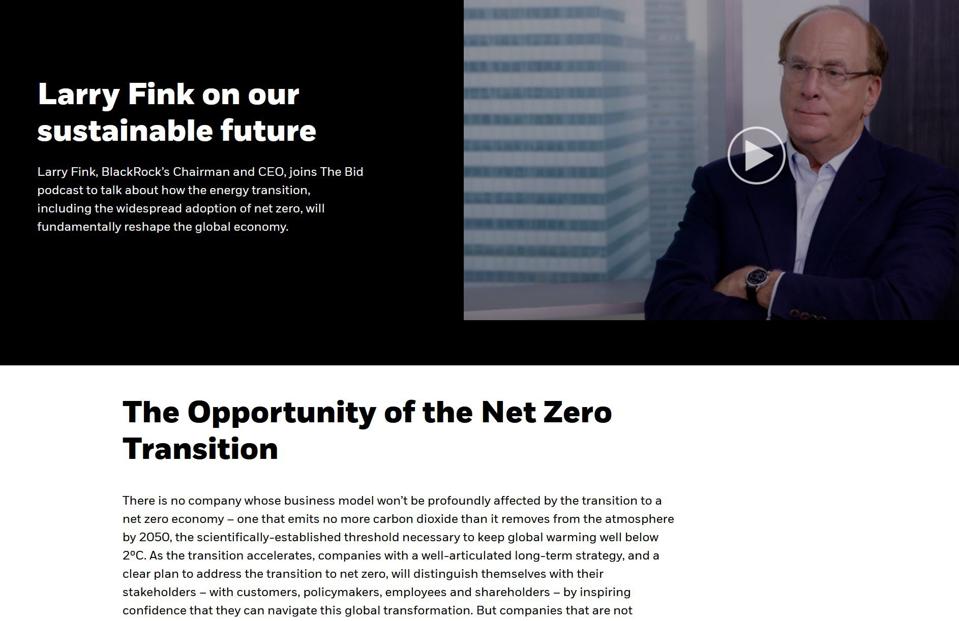

Screen shot of BlackRock CEO Larry Fink 2021 letter to shareholders on blackrock.com

blackrock.com screen shot

“There is no company whose business model won’t be profoundly affected by the transition to a net zero economy – one that emits no more carbon dioxide than it removes from the atmosphere by 2050, the scientifically-established threshold necessary to keep global warming well below 2ºC,” Larry Fink, the CEO of the world’s largest asset manager, BlackRock wrote in his 2021 letter to shareholders. “As the transition accelerates, companies with a well-articulated long-term strategy, and a clear plan to address the transition to net zero, will distinguish themselves with their stakeholders – with customers, policymakers, employees and shareholders – by inspiring confidence that they can navigate this global transformation. But companies that are not quickly preparing themselves will see their businesses and valuations suffer.”

Other shareholders are taking matters into their own hands too, as we saw recently when climate-focused shareholder activists won additions to the Exxon-Mobil board of directors, and a shareholder “rebellion” at Chevron is forcing them to more rapidly reduce emissions.

Nasdaq reports that in 2021, “about 77% of professional fund selectors and 75% of institutional investors considered ESG factors an integral part of sound investing…. Around 51% more institutional investors and 45% more fund selectors engaged in active ownership of ESG investments in 2020, compared to 2019.”

So the spotlight is on ESG accountability.

81% of global sustainability indexes outperformed their counterparts – “a sustainability premium”

Screen shot from Nasdaq.com on ESG popularity

nasdaq.com

Fink and other ESG investment leaders have said this values lens is good for your bottom line too, for both the short term and the long term. He calls it a “sustainability premium,” which enables the company to seize opportunities and increases the company’s resilience, therefore, protecting it from physical and financial disaster.

“Over the course of 2020, we have seen how purposeful companies, with better environmental, social, and governance (ESG) profiles, have outperformed their peers,” Fink wrote in his 2021 letter to shareholders. “During 2020, 81% of a globally-representative selection of sustainable indexes outperformed their parent benchmarks. This outperformance was even more pronounced during the first quarter downturn, another instance of sustainable funds’ resilience that we have seen in prior downturns.…But the story goes deeper. It’s not just that broad-market ESG indexes are outperforming counterparts. It’s that within industries – from automobiles to banks to oil and gas companies – we are seeing another divergence: companies with better ESG profiles are performing better than their peers, enjoying a ‘sustainability premium.’”

Reporting today is voluntary and inconsistent. That’s changing.

Today, companies report what they want and don’t report what they don’t want, which generally means they hide what makes them look bad and crow about what makes them look good. But that’s about to change.

NEW YORK, NEW YORK – The New York Stock Exchange (NYSE) (Photo by Spencer Platt/Getty Images)

Getty Images

The Securities and Exchange Commission (SEC) recently announced the first ever head of ESG. They also recently requested public comments for the best way for the SEC to encourage disclosure of the impact on, and risk of, climate change to businesses. They are asking, for example, “How can the Commission best regulate, monitor, review, and guide climate change disclosures in order to provide more consistent, comparable, and reliable information for investors while also providing greater clarity to registrants as to what is expected of them? Where and how should such disclosures be provided?”

The alphabet soup of reporting standards are coordinating to bring more clarity and consistency to standards too. For example, the Sustainable Accounting Standards Board (SASB) just finalized its merger with the International Integrated Reporting Council (IIRC) to form the Value Reporting Foundation, integrating their ESG reporting frameworks to provide more “holistic” and consistent ESG reporting, based on both qualitative and quantitative data, as SASB/VRF CEO Janine Guillot explained in a press conference this week.

SASB/VRF is also collaborating with the International Financial Reporting Standards Foundation on developing an International Sustainability Standards Board, to establish globally consistent ESG standards. And, the World Economic Forum and GRI are collaborating with SASB/VRF to provide more clear and consistent standards too.

Holding companies and leaders accountable to drive change

Nasdaq says that “35% of institutional investors pointed to the influence on corporate behavior as a major reason why they have adopted these investments.”

PLEASANTON, CA – Employees of SPG Solar mount a photovoltaic panel (Photo by Robert … [+]

Getty Images

How environmental and social impacts are disclosed matters for all of us, not just investors. It matters if we want corporate leaders to change their processes to be more environmentally friendly and meet net zero standards. Any leader worth their salary will tell you that what gets measured is what matters, and where they focus attention and resources.

It matters because we need businesses to be good corporate citizens, to make positive changes in the economy and the planet, because they control and influence so many resources. It matters if we want leaders to treat people well and equitably and to have diversity across their ranks.

Then-Chairman and CEO of Xerox Ursula Burns speaks onstage at the FORTUNE Most Powerful Women … [+]

getty

Investors and talent who make decisions through this ESG lens are increasing in power – financial power, political power and social power, including Millennials, women and people of color – and they are demanding corporate disclosure and action.

We’ll see if it works.