Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a small share of the revenue from the sale from our commerce partners.

Artificial Intelligence (AI) is undoubtedly the next big technological frontier. Generative AI is projected to become a massive $1.3 trillion market by 2032. Meanwhile, major tech companies continue to invest heavily in the AI sector, unlocking capabilities that were previously unimaginable.

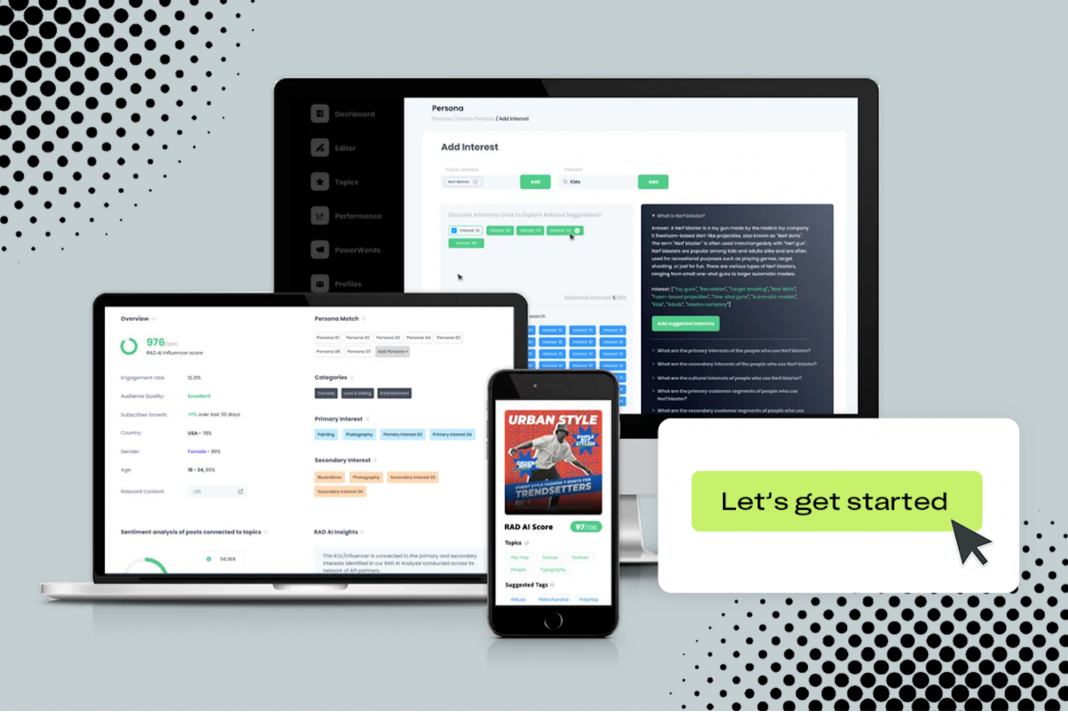

However, the true winners in the AI revolution will be those who can effectively leverage it to solve real-world problems. This is the approach taken by RAD AI, a company that uses AI to streamline and optimize marketing efforts for its clients, many of whom are well-known brands. With thousands of investors already backing the company’s growth, RAD AI stands at the forefront of this transformative shift.

Let’s explore the trends shaping the AI landscape and how RAD AI is positioned to influence the market.

Accelerating RAD AI’s growth through strategic AI acquisitions.

As the AI era continues to evolve, RAD AI is poised to among those leading the charge. The company is unveiling a groundbreaking strategy called Artificial Intelligence Buyouts (“AIBOs”), which aims to redefine the industry’s landscape.

The rationale behind AIBOs lies in the untapped potential within the creator economy. RAD AI has identified a significant gap, where small- and medium-size agencies—crucial to the creator economy’s ecosystem—often lack the advanced AI capabilities needed to fully optimize their operations and client engagements. By strategically acquiring these agencies and integrating RAD AI’s award-winning technology, the company can empower these agencies to enhance their efficiency, client acquisition, and long-term value.

The recent success of RAD AI’s crowdfunding initiative has provided the necessary capital to begin realizing this vision. Furthermore, the planned Regulation A+ public fundraise in the second half of 2024 will further fuel the company’s ambitions, enabling it to strategically acquire and transform agencies that can benefit most from RAD AI’s AI innovations.

The value proposition: Immediate impact and long-term growth.

The integration of AIBOs into RAD AI’s growth strategy has the potential to create significant value for shareholders. By leveraging RAD AI’s technology platform and capabilities, the acquired agencies can immediately see improvements in efficiency, client satisfaction, and profitability, directly benefiting the company’s investors through increased valuation and market presence.

A bold future with AIBOs.

As RAD AI unveils its AIBOs strategy, the company is on the cusp of a transformative future. This vision underscores RAD AI’s commitment to leading the AI-driven marketing revolution and ensuring its investors are part of a journey marked by groundbreaking innovation, rapid growth, and substantial value creation.

For investors seeking to capitalize on the AI renaissance, RAD AI presents a compelling opportunity. With more than 6,500 investors already backing the company, RAD AI is poised to drive the next wave of AI-powered solutions that will redefine marketing strategies and drive business success.

Disclosure: This is a paid advertisement for RAD AI’s Regulation CF offering. Please read the offering circular at invest.radintel.ai

*The company is considering undertaking an offering under Regulation A. The company is not under any obligation to make an offering under Regulation A. It may choose to make an offering to some, but not all, of the people who indicate an interest in investing, and that offering might not be made under Regulation.. If the company does go ahead with an offering, no offer to buy the securities can be accepted and no part of the purchase price can be received until it has filed an offering statement with the Securities and Exchange Commission (SEC) and only then accepted through the intermediary’s platform. The information in that offering statement will be more complete than the information the company is providing now, and could differ in important ways. You must read the documents filed with the sec before investing. No money or other consideration is being solicited with the indications of interest, and if sent in response, will not be accepted. Indications of interest involve no obligation or commitment of any kind.